Editor's Choice

A landfill in Wales is closing, where it is allegedly buried a hard drive with 8,000 bitcoins worth $768 million. James Howells continues his fight to recover them after the disk was lost in 2013 💻

A landfill in Newport, Wales, is closing, where it is claimed a hard drive containing 8,000 bitcoins, valued at $768 million, is buried. James Howells, an IT specialist who lost the disk in 2013, has sued local authorities in an attempt to obtain permission for excavation. The authorities refused, citing environmental risks. The losses of bitcoins in such landfills can reach up to 13 percent of all coins, posing a threat to the cryptocurrency market. The court rulings in Howells' case have drawn attention to the issue of lost digital assets and their impact on the market.

Roskomnadzor has blocked the largest cryptocurrency aggregator BestChange in Russia and Eastern Europe amid new cryptocurrency restrictions. The platform stated its intention to work on lifting the block 🛑

Roskomnadzor has blocked the largest cryptocurrency aggregator BestChange, serving users in Russia and Eastern Europe. The reasons for the blocking are not specified, but the platform has faced similar sanctions in 2017 and 2019. This happened against the backdrop of stricter cryptocurrency legislation in Russia, which restricts advertising and services related to digital assets, as well as blocking platforms that allow cryptocurrency transfers through Russian infrastructure. The platform stated that it has started working with lawyers to lift the restrictions.

WazirX updates the platform: the new **Preliminary Creditor List** and **July 18** page help users track claims and token balances. Migration of funds to new wallets will improve security and asset management 🔍

WazirX strengthens the transparency of its restructuring by adding the Preliminary Creditor List and the July 18 page. The list allows users to check the amounts of their claims in USD via a unique UUID, while the new page displays token and deposit balances as of 13:00 IST on July 18, 2024. To simplify search, a “Find my balance” feature has been added. The platform also announced the migration of funds to new wallets for improved security and efficiency. These measures are aimed at enhancing user confidence in the restructuring process and improving asset management.

Elon Musk is not interested in buying TikTok: The CEO of Tesla and SpaceX explained that there is no clear goal, apart from the economic one, for a deal with the Chinese app 💡

Elon Musk stated that he does not plan to acquire TikTok, despite rumors of a potential deal. In an interview at the WELT Economic Summit, he emphasized that purchasing the company has no clear goal for him, apart from the economic one. Musk noted that he previously bought Twitter to protect freedom of speech, but a similar rationale does not apply to TikTok. The main value of the app is its algorithm, which influences the user experience, and Musk pointed out that this is a key factor when considering any deal. TikTok remains under the control of Chinese ByteDance, despite interest from other investors.

Hong Kong begins accepting Bitcoin (BTC) and Ethereum (ETH) as asset proof for investment immigration: minimum amount — 30 million Hong Kong dollars 🌏

Three British nationals were arrested in Spain for kidnapping a cryptocurrency trader and demanding €30,000 for his release. During the operation, money, weapons, and drugs were seized 🔫

The University of Austin is launching a Bitcoin-based fund worth over $5 million with a five-year HODL strategy. The institution is investing in cryptocurrency as part of its $200 million fund, confident in its long-term value 🚀

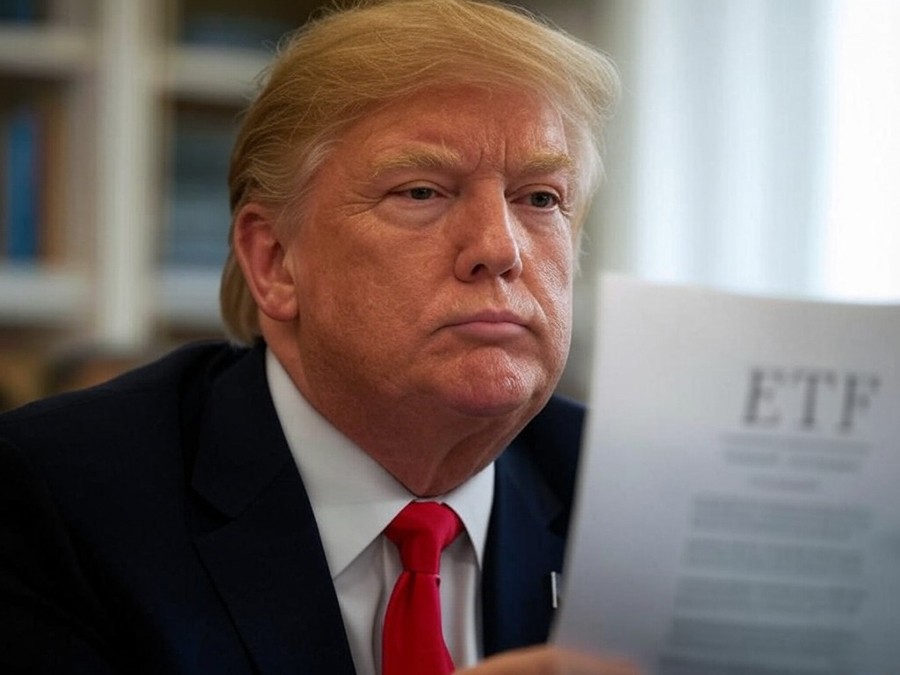

Trump Media is launching three new exchange-traded funds under the Truth.Fi brand, including the Truth.Fi Bitcoin Plus ETF, which tracks the price of Bitcoin, and two others aimed at supporting the American economy 💰

The SEC recognized Grayscale's application for a spot ETF for Solana: an important step toward approving cryptocurrency funds in the U.S. with a forecast of attracting up to $6 billion in the first year 📊

The CFTC launches a forum for leaders in the crypto industry: discussion of the pilot program on tokenized collateral, including stablecoins and cryptocurrencies, as part of regulatory reform and consumer protection 🏛️

The Japanese Financial Services Agency has demanded that Apple and Google remove the apps of five unregistered cryptocurrency exchanges, including Bybit and KuCoin. This is a step toward compliance with local regulations and investor protection 💼

Alternative for Germany (AfD) proposes leaving the euro and deregulating Bitcoin, while the CDU/CSU, SPD, and the Greens focus on tax reforms and financial stability ahead of the elections in Germany 💰

Hackers hijacked Mahathir Mohamad's account on X to promote the fake cryptocurrency "Malaysia" on the Solana blockchain. Over $1.7 million stolen before the token collapsed 🚨

Hackers hijacked the account of former Malaysian Prime Minister Mahathir Mohamad on X and used it to promote a fake cryptocurrency "Malaysia" on the Solana blockchain. A post claiming it was the country's official cryptocurrency quickly attracted investors, but the token collapsed, and over $1.7 million was stolen. Fraud schemes using the accounts of famous people to create "pump-and-dump" schemes are becoming more common. Cryptocurrency market experts warn of an increase in such cases.

The Swedish company Virtune has launched an ETP supported by Cardano (ADA), offering a 2 percent annual staking reward and secure storage via Coinbase. This strengthens ADA’s position in the crypto market 📈

The Swedish investment company Virtune has launched an exchange-traded product (ETP) supported by Cardano (ADA), which gives investors the opportunity to earn staking rewards (2 percent per year) and ensures secure storage through Coinbase. This move strengthens the position of ADA as an important asset in the market, alongside cryptocurrencies like Bitcoin, Ethereum, Solana, and XRP, for which similar products already exist. This could attract new institutional investors and increase liquidity. Despite the current bearish trend in the market, with ADA dropping to $0.75, the launch of the ETP could play a key role in the long-term recovery of Cardano.

Soneium, Sony's blockchain, has launched its first collection of music NFTs featuring an unreleased track by NUU$HI in partnership with Coop Records. The collection is available for minting on Sonova for 0.000777 ETH 🎶

Soneium, Sony's blockchain, has released its first collection of music NFTs in collaboration with Coop Records. Including an unreleased track by Japanese producer NUU$HI, the collection is available on the Sonova marketplace for 0.000777 ETH until the end of the month. This launch is a step towards integrating blockchain technologies into the music industry, creating new opportunities for artists. Inspired by the desire to improve revenue models and fair distribution, Coop Records has transferred over 600 songs to the blockchain. Since the launch of Soneium in January 2025, the platform has gained over 245,000 active users, demonstrating rapid growth in the music segment.

Alexey Percev, the developer of Tornado Cash, will be released from prison on Friday after a 2022 detention in a money laundering case via a service for anonymizing Ethereum transactions. The appeal is in process ⚖️

Alexey Percev, the developer of Tornado Cash, will be released from prison on Friday, completing his pre-trial detention before appealing his money laundering case. He was sentenced in May 2024 to 64 months for creating a service that hides transactions on the Ethereum network. Percev filed an appeal after a US court ruled that sanctions against Tornado Cash were illegal. He stated that the release gives him the chance to work on the appeal, although it is not full freedom.

Best news of the last 10 days

Public Citizen demands an investigation into the possible violation of US laws through the meme coin TRUMP: concerns about gifts from foreign individuals and its price drop by 76 percent 🚨

Czech Republic introduces tax exemption for Bitcoin holders and other digital assets who hold them for more than 3 years, starting from mid-2025, in line with EU regulations 💸

Tether and Reelly Tech launch the use of USDT for real estate transactions in the UAE: over 30,000 agents gain access to stablecoin to enhance the security and speed of transactions 🏡

The Canadian organization CIRO excluded cryptocurrency funds from the list for reduced margin rates: investors will be required to provide more collateral, which will increase the cost of cryptocurrency positions 📉

Telegram requires third-party cryptocurrency wallets to use TON Connect, limiting support to the TON blockchain: the new requirements will take effect by February 21 💬

Telegram requires all third-party crypto wallets to use TON Connect, limiting support to the TON blockchain only. All Mini Apps running on other blockchains must switch to TON by February 21. Otherwise, Telegram will suspend their operation. This move has sparked criticism from developers concerned about centralization and platform monopolization. Some wallets, such as Bitget Wallet Lite, have already integrated TON Connect to comply with the new requirements.

The US is creating a bicameral commission to develop federal regulation of стейблкоины and digital assets: focus on innovation, consumer protection, and market integrity 💼

On February 4, David Sacks, the crypto-Caesar of the Trump administration, announced the creation of a bicameral commission to develop a federal framework for regulating cryptocurrencies, including стейблкоины. Senator Bill Hagerty introduced a bill to establish regulatory frameworks for стейблкоины, and Senator Tim Scott announced plans to pass laws within the first 100 days of the new government. An important task is to bring innovation back to the US for better control and consumer protection. All initiatives are aimed at creating a clear and comprehensive regulation to stimulate innovation and market integrity.

Elon Musk and his DOGE team have gained access to the U.S. federal payment system with read-only rights, raising concerns about control over 90 percent of all federal payments 💵

Elon Musk's team in the "Department of Government Efficiency" gained access to the U.S. Treasury's federal payment system with read-only rights, which did not affect payments, including Social Security and Medicare. However, Democrats, including Senator Elizabeth Warren, expressed concern that DOGE, which processes about 90 percent of all federal payments, could limit access to funds. In response, the Treasury stated that Musk and his team's access did not impact the functionality of the system.

Hong Kong is accelerating the creation of a strategic Bitcoin reserve and the development of Web3, as well as expanding opportunities for stablecoins and virtual assets in response to global digital trends 📊

Hong Kong is actively developing cryptocurrency initiatives, including the creation of a strategic Bitcoin reserve. The city is setting up working groups and subcommittees focused on the development of Web3 and stablecoins, as well as accelerating the testing of new technologies. According to lawmaker Johnny Ng, to maintain competitiveness, the development in these areas needs to be accelerated. At the same time, the United States is also discussing the creation of Bitcoin reserves and the development of cryptocurrency regulations, which will strengthen their role in the global digital asset market.