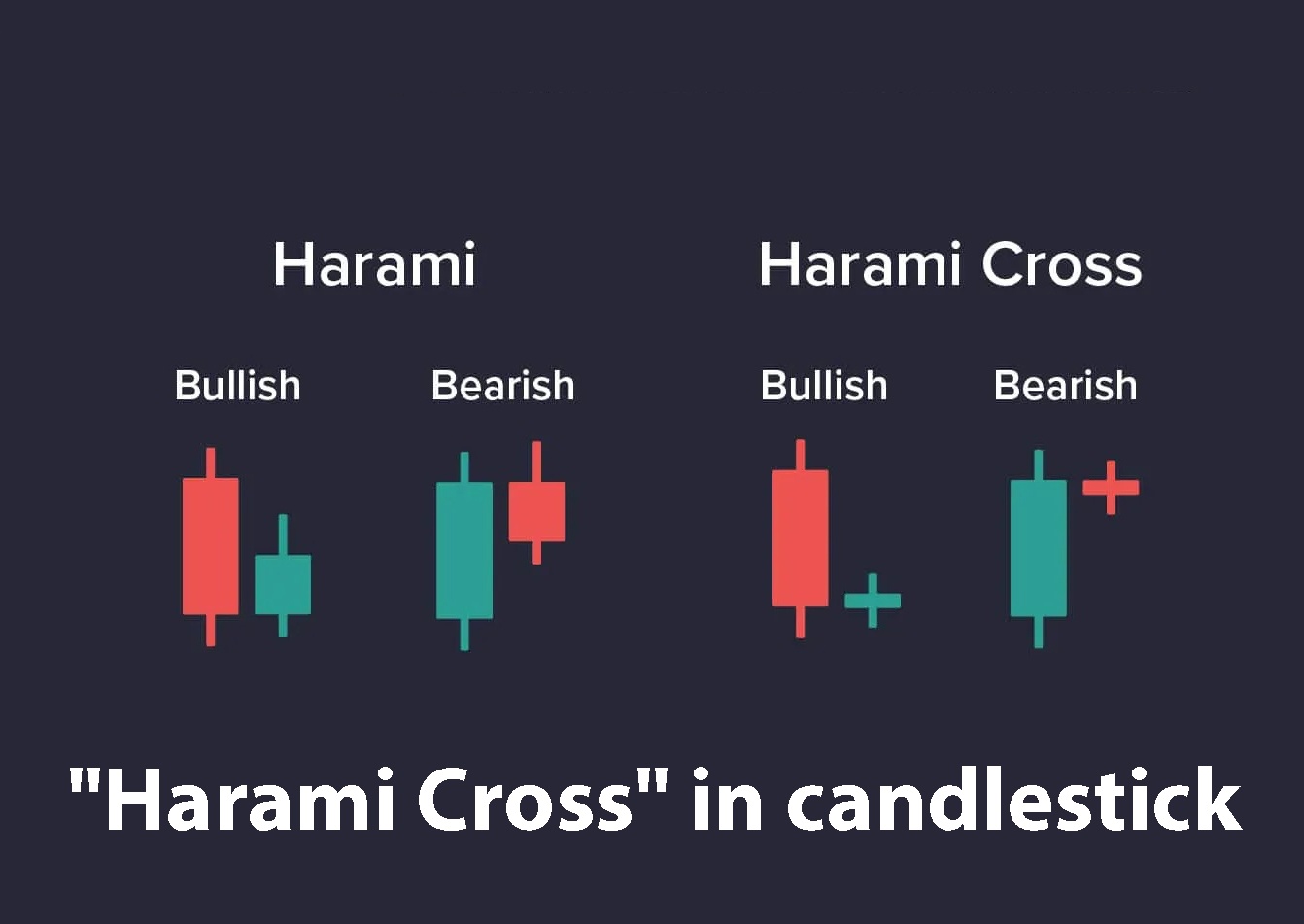

The "Harami Cross" is an important pattern in technical analysis used for predicting trend reversals. This pattern consists of two candles: the first one has a long body, and the second one has a small body, which is completely within the body of the first candle. The appearance of the "Harami Cross" can signal a possible change in the trend direction, especially if it appears at significant support or resistance levels. It is important to consider the context and other indicators for more accurate predictions.

12/11/2024 3:22:49 PM (GMT+1)

What is the "Harami Cross" in candlestick analysis?

This material was prepared by Khachatur Davtyan, developed and translated by artificial intelligence.