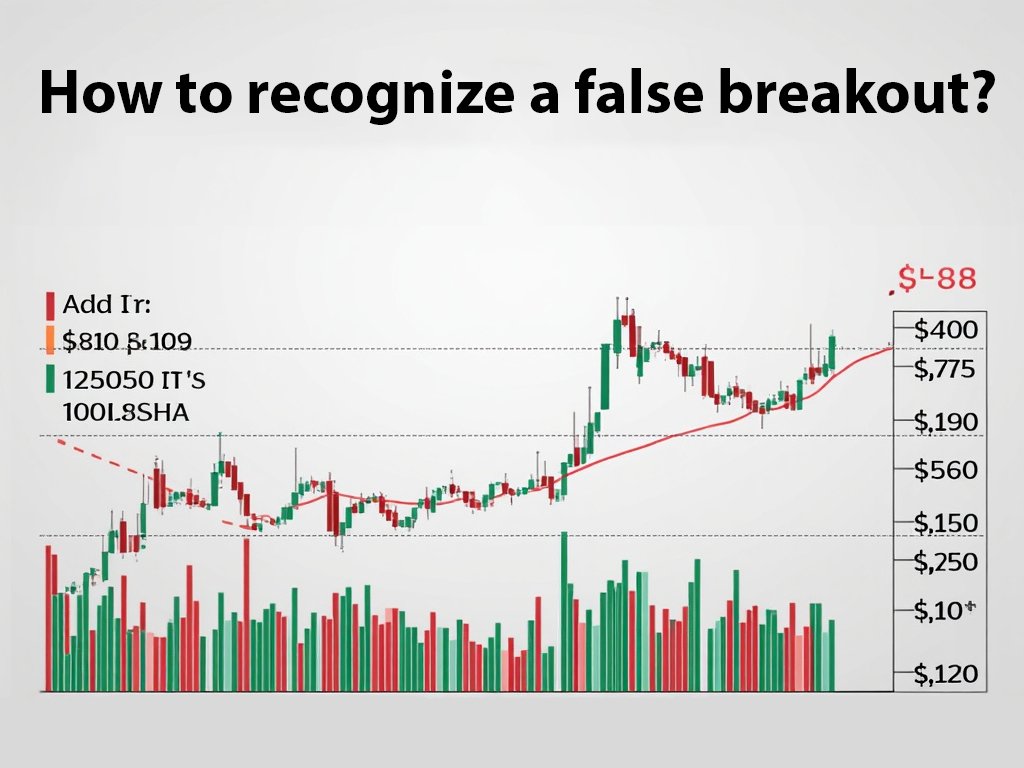

A false breakout is a situation where the price of an asset temporarily breaks through a key level, but then returns back. Such movements can confuse traders and lead to incorrect decisions. To recognize a false breakout, it is important to consider several factors:

1. **Volume**: Low volume during a breakout may signal a false move.

2. **Time**: Short-term breakouts often turn out to be false.

3. **Return to the level**: If the price quickly returns to the breakout level, it may indicate a false signal.

4. **Retest**: The absence of a retest after the breakout is another indicator to consider.

Traders using these strategies can avoid traps and improve the accuracy of their trades.