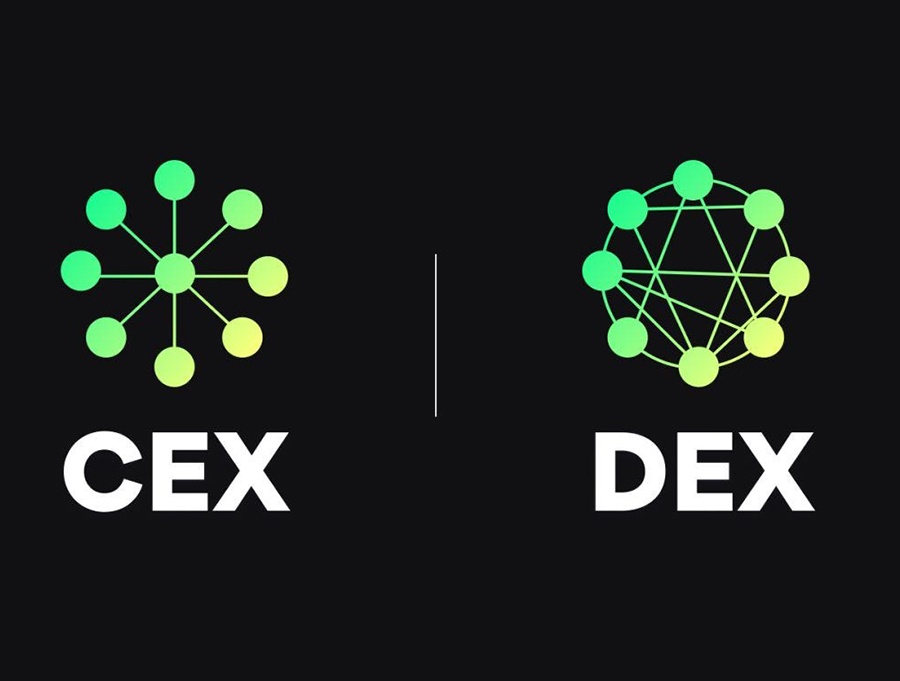

With the development of the cryptocurrency industry, one of the most discussed topics has been the difference between centralized (CEX) and decentralized exchanges (DEX). While CEX platforms such as Binance or Coinbase provide users with user-friendly interfaces and high liquidity, decentralized platforms are fundamentally changing the approach to trading and ensuring security.

What is a DEX?

Decentralized exchanges are platforms that allow users to trade cryptocurrencies directly with each other, bypassing a central intermediary. All operations occur on the blockchain, reducing the risks of asset loss due to hacking or financial manipulations that are common with centralized exchanges.

Advantages of DEX over CEX

- Security: DEX systems allow users to retain full control over their assets, reducing the risk of theft in the event of an exchange hack. On CEX, funds are stored in exchange accounts, making them vulnerable.

- Transparency: Every transaction on a DEX is recorded on the blockchain, ensuring full transparency. This contrasts with centralized platforms, where processes are often hidden from users.

- Accessibility and Freedom: DEX do not require registration or identity verification, offering anonymity and freedom in trading for users worldwide, regardless of their country of residence.

- Reduced Manipulations: Since there is no single governing body on a DEX, operations are less susceptible to manipulation by exchange owners, as often happens with centralized platforms.

Recent achievements in blockchain

In recent years, technologies like automated market makers (AMM) have made trading on DEX much more convenient and liquid. Protocols like Uniswap and SushiSwap provide stability and liquidity, allowing users to easily swap tokens without relying on third parties.

The future of DEX

Each year, decentralized exchanges continue to evolve, implementing new technologies to improve scalability and user experience. Integration with Layer 2 solutions (e.g., Optimism and Arbitrum) is expected soon, which will further speed up processes and reduce fees.

In conclusion, while centralized exchanges offer convenience and ease of use, decentralized platforms offer much more in terms of security, transparency, and control over assets. With the growing popularity of cryptocurrencies and blockchain technologies, decentralized exchanges are likely to become the main players in the world of digital assets.