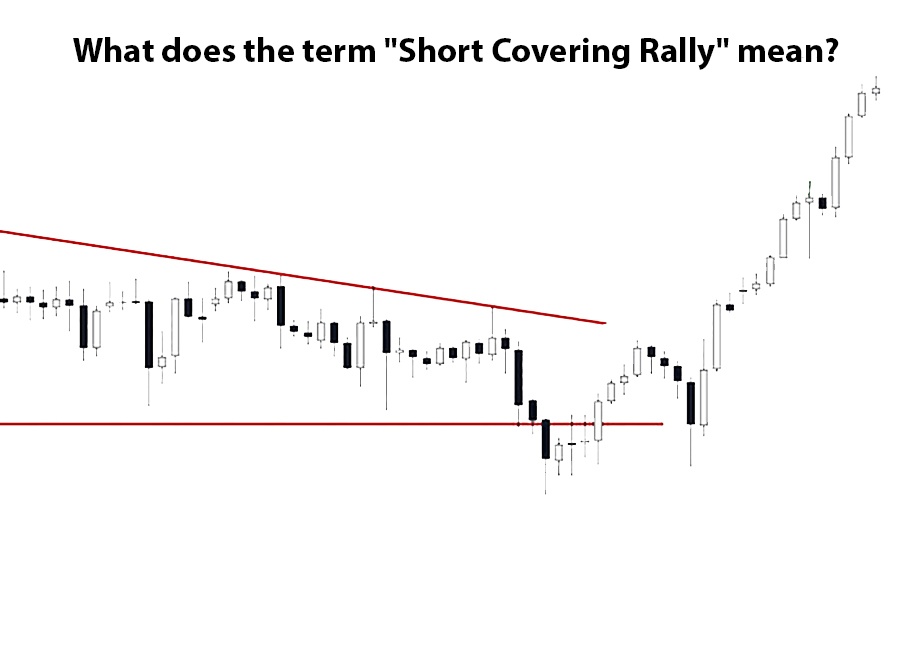

The term "Short Covering Rally" describes a situation in the market when investors holding short positions begin to actively close them, causing prices to rise. Short positions involve traders betting on a decline in an asset's value. However, if the price unexpectedly starts to rise, they are forced to buy back the stocks to limit their losses. This process of buying back creates additional upward momentum, triggering what is known as a "rally." Such moves are often short-term and can be caused by new data or events that shock the market.

12/19/2024 12:56:03 PM (GMT+1)

What does the term "Short Covering Rally" mean?

This material was prepared by Khachatur Davtyan, developed and translated by artificial intelligence.