Editor's Choice

Singapore has blocked access to Polymarket, urging users to take responsibility for participating in unlicensed online betting, with fines of up to $10,000 and prison terms of up to 6 months ⏳

Singapore has blocked access to Polymarket as part of its fight against unlicensed online betting. Offenders may be fined up to $10,000 or sentenced to 6 months in prison. The only legal online betting operator in the country remains Singapore Pools. This restriction is part of a large-scale campaign against illegal gambling, during which $37 million in transactions were blocked. Political betting on Polymarket is also restricted in other countries, including Taiwan, France, and the United States.

The Litecoin account on X was hacked to promote a fake token on Solana: hackers used a compromised delegated account, Litecoin regained control 🔒

On January 11, the Litecoin account on the social media platform X was hacked to promote a fake token on the Solana network. The hacker posted a message with errors, claiming that Litecoin now exists on Solana, and attached a link to the fraudulent token. The Litecoin team regained control of the account, stating that the hack occurred via a compromised delegated account. This event is part of a series of account hacks aimed at spreading fake tokens and phishing links.

FTX disclosed the payout schedule for creditors amounting to $16 billion: the first payments for creditors with claims up to $50,000 will begin in February, continuing until March 4, with preliminary formalities to be completed by January 20 📅

FTX announced the start of creditor payouts totaling $16 billion, with the expected start in February. Initially, creditors with claims up to $50,000 will receive funds, amounting to about $1.2 billion. To participate in the payouts, several formalities must be completed by January 20, including submitting the tax form. The payouts will continue until March 4. This process has caused optimism in the cryptocurrency market, as many expect the return of funds to contribute to the growth of cryptocurrencies.

Mango Markets is shutting down after settling with the SEC: a $700,000 fine, destruction of MNGO tokens, and the consequences of a $100 million hack in 2022, which led to financial troubles 🚫

Mango Markets, a decentralized exchange on Solana, is shutting down after settling with the SEC and voting on internal changes. The SEC accused Mango of selling unregistered securities worth $70 million in 2021. As part of the settlement, the company will pay a $700,000 fine, destroy MNGO tokens, and request exchanges to remove them from their platforms. Additionally, the platform was affected by a hack in 2022, when trader Eisenberg withdrew $100 million, returning only a portion of the funds.

CFPB proposed a new law requiring crypto service providers to reimburse funds to users in case of theft or fraud, extending protection to cryptocurrency accounts 🔒

The Hong Kong Monetary Authority launches a support program for banks to implement distributed ledger technology with a focus on tokenized deposits and secure testing 🔗

New Hampshire proposed a bill to create a strategic Bitcoin reserve, allowing the investment of up to ten percent of state funds in digital assets and stablecoins 💰

A federal grand jury in Georgia indicted three Russians for involvement in cryptocurrency mixers Blender.io and Sinbad.io, which were used for laundering stolen funds through Bitcoin and other cryptocurrencies 🔒

Bybit suspends all services in India from January 12, 2025, due to regulatory issues, including the blocking of deposits, trading positions, and P2P advertising, while maintaining the withdrawal function 🛑

WazirX presents a restructuring plan after the hacker attack of $235 million in July 2024: compensation to users via recovery tokens and the Settlement Scheme in Singapore ⚖️

Co-founder of Wolf Capital Travis Ford confessed to fraud, luring 2,800 investors into a financial pyramid worth $9.4 million with a promise of 547 percent annual returns 💰

Standard Chartered has opened a division in Luxembourg for cryptocurrency and digital asset custody, following the MiCA regulation, and plans to expand services with the acquisition of a CASP license 💼

Ripple Labs donated $50,000 to the Los Angeles Fire Department Foundation to support the fight against wildfires that have impacted Pacific Palisades, Altadena, Pasadena, and Calabasas 🚒

Ripple Labs donated $50,000 to the Los Angeles Fire Department Foundation in response to the devastating wildfires that began on January 7. The fires affected the Pacific Palisades, Altadena, Pasadena, and Calabasas areas, leading to the evacuation of over 150,000 people and resulting in at least 10 casualties. The donation was made through the stablecoin RLUSD. The Los Angeles Fire Department expressed gratitude for the company’s support during this challenging time, highlighting the importance of such aid.

Thailand launches a pilot program in Phuket allowing tourists to use Bitcoin to pay for goods and services with mandatory identification and conversion to Thai baht 🌴

Thailand launches a pilot program in Phuket that will allow tourists to use Bitcoin to pay for goods and services. Foreign guests will be able to register on cryptocurrency exchanges, undergo the identification process, and pay for purchases using cryptocurrency. All transactions will be automatically converted into Thai baht. This initiative aims to simplify digital payments and attract foreign tourists. Additionally, it may help refugees use Bitcoin to purchase real estate, bypassing the difficulties with currency exchange.

Philippine banks are launching a multi-bank stablecoin PHPX on the Hedera DLT platform for cross-border payments and stable currency exchange with the ability for instant transfers 🚀

In 2025, several Philippine banks, including UnionBank, will launch a multi-bank stablecoin PHPX, which will operate on the Hedera DLT network. It will provide fast and secure cross-border payments, especially for migrants sending money home. The stablecoin will not only allow sending money but also paying bills and investing in financial products. A stablecoin exchange for different currencies will also be created, and the reserves of PHPX will be secured through bank trust accounts. The launch is scheduled for May-July 2025.

The United Kingdom excludes cryptocurrency staking from collective investment schemes, clarifying its status in the updated Financial Services and Markets Act, which will come into force on January 31 📅

In the United Kingdom, cryptocurrency staking will no longer be considered a collective investment scheme. The Treasury clarified that cryptocurrency staking does not fall under the definition of a collective investment scheme, unlike mutual and exchange-traded funds, which are regulated by financial oversight. Staking is the process of locking tokens to validate transactions on the blockchain, for which users receive rewards. The new changes will take effect on January 31 and will apply to all parts of the United Kingdom.

Best news of the last 10 days

Russian authorities confiscated 1032.1 bitcoins from the former investigator Marat Tambiev, valued at over 1 billion rubles, after his conviction for receiving the largest bribe in the country's history 💸

Circle made a donation of $1 million in USDC to the inauguration of Donald Trump, highlighting the growing recognition of digital currencies and support for the crypto industry in his policy 💡

The court rejected James Howell's claim to recover the hard drive with £600 million in bitcoins lost on a landfill in 2013: the expert plans to appeal to the Supreme Court 💰

Nischal Shetty missed a key court hearing in Singapore concerning the WazirX case, intensifying investor dissatisfaction and raising questions about his accountability in the platform's crisis ⚖️

In Thailand, 996 Bitcoin mining machines were seized at a farm in Chonburi, where electricity was stolen, causing damage in the hundreds of millions of baht, using a fake meter ⚡

Almost 1,000 Bitcoin mining machines were seized in Thailand after electricity theft was discovered at a farm in Chonburi. Operators used a fake meter to mine cryptocurrency without paying for electricity. The theft occurred at night, while during the day the meter showed correct readings. The estimated damage is in the hundreds of millions of baht. The investigation is ongoing, but the culprits have not yet been identified.

The Financial Services Commission of South Korea has announced a plan to allow corporate investments in virtual assets and the development of a new law on virtual assets, including stablecoins and asset listings 📊

The Financial Services Commission of South Korea (FSC) has announced a plan to allow corporate investments in virtual assets, starting with non-profit organizations. As part of this, the possibility of opening real accounts for companies will be discussed. The FSC is developing a new law on virtual assets that will include rules for stablecoins and asset listings. Kwon Dae-yeon of the FSC emphasized the importance of market transparency and security for attracting investors and meeting international standards.

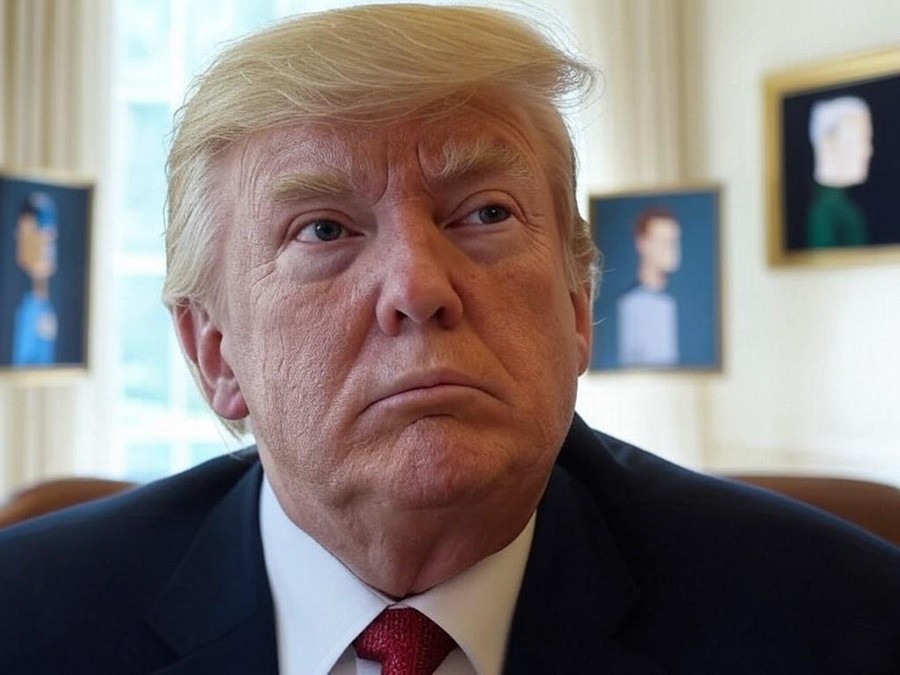

Donald Trump launches his fifth NFT collection on the Bitcoin blockchain using the Ordinals protocol, available only to holders of "Mugshot Edition" cards until January 31 🎨

Donald Trump has unveiled his fifth NFT collection, created on the Bitcoin blockchain using the Ordinals protocol. The collection consists of 160 unique tokens and is only available to owners of the previous "Mugshot Edition" cards. To obtain the new NFTs, collectors must apply through the Magic Eden platform by January 31. Since the first release of NFTs in 2022, Trump has continued to actively use token sales to fund his campaign and supports the crypto industry.

Bitstamp has added the Ripple stablecoin RLUSD to Ethereum, offering trading pairs with USD, EUR, BTC, ETH, XRP, and USDT, backed 1:1 by the US dollar and complying with strict regulatory standards 📜

Bitstamp has added the Ripple stablecoin RLUSD to its platform, offering trading pairs with USD, EUR, BTC, ETH, XRP, and USDT. RLUSD is pegged to the US dollar at a 1:1 ratio and complies with strict regulatory standards, issued under the New York Trust Charter. This stablecoin is intended for use in payments, tokenization, and DeFi applications. It provides businesses with a stable and reliable tool for integration with blockchain ecosystems, including on the Ethereum platform, enhancing Ripple's financial solutions for businesses.